Search Posts

Recent Posts

- Do you meet the definition of an “Accredited Investor” under the new SEC Rules? December 8, 2020

- Do You Really Have Time To Read & Understand The Heroes Act? November 23, 2020

- Governor Newsom – Please Order all Court Buildings in the State of California Closed starting March 16 March 15, 2020

- Three Men Arrested in $722 Million Cryptocurrency Fraud Scheme Targeting “Dumb” Investors December 10, 2019

- Should Court Transcripts be Provided to Parties Free of Charge? December 3, 2019

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

SEC shutdown Telegram’s allegedly illegal ICO that raised over $1.7 Billion of Investor Funds

The U.S. Securities and Exchange Commission’s (SEC) Cyber Unit is actively fulfilling its promise to protect investors against cyber-related misconduct involving distributed ledger technology and ICOs. Earlier today, the SEC issued a press release to announce that it has filed an emergency action and obtained a temporary restraining order against two offshore entities, Telegram Group Inc. and TON Issuer Inc., (together “Defendants”) conducting an alleged unregistered, ongoing digital token offering in the U.S. and overseas that has raised more than $1.7 billion of investor funds. Defendants are owners and operators of the popular mobile messaging application Telegram Messenger, an encrypted messaging application with approximately 300 million monthly users worldwide that has been called the “cryptocurrency worlds’ preferred messaging app.”

What were the Commission’s reasons for shutting down this ICO?

The SEC complaint states that the Defendants violated Sections 5(a) and 5(c) of the Securities Act of 1933 (“Securities Act”) because of the following:

- No registration statement on file: Defendants’ illegal offering (the “Offering”) was occurring in violation of the registration provisions of the federal securities laws. Defendants did not file a registration statement for the illegal offering of digital-asset securities called “Grams” as required under the Securities Act.

- Distribution/Delivery of Grams was imminent: The Defendants were planning to flood the U.S. capital markets with billions of Grams by October 31, 2019 without providing investors important information about their business operations, financial condition, risk factors and management.

Many illegal ICOs have failed to file a registration statement or qualify for an exemption under the federal securities laws, such as the CentraTech and the Titanium Blockchain ICOs. You can read those SEC complaints by clicking on the CentraTech SEC complaint and the Titanium Blockchain SEC complaint.

Grams are Securities under the Howey Analysis

The following breaks down why, according to the SEC, Grams satisfied the four elements of an “investment contract” under SEC v. W.J. Howey Co. (Howey Analysis):

- Investment of money: This element was clearly met.

- In a common enterprise: The SEC cites information contained in the Defendants’ various Offering Documents and statements made by Defendants that meet the element of “in a common enterprise.”

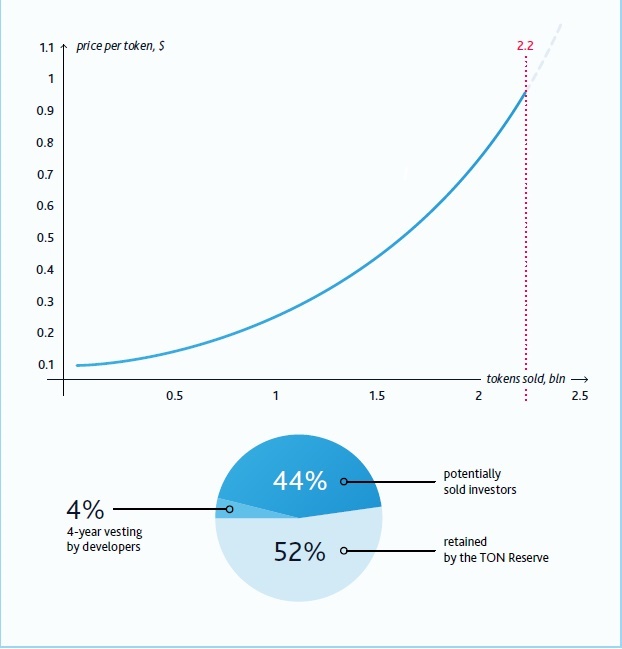

- With a reasonable expectation of profits: Offering Documents included the graphic below illustrated the effect of Telegram’s Formula (described below):

Under Telegram’s Formula, Defendants would price the first Gram at $0.10, and every subsequent Gram at an amount one-billionth higher than the prior sales price. As such, Telegram designed the price of Grams to increase “exponential[ly].” Indeed, Telegram sold Grams to purchasers at a deep discount to an expected market price of $3.62 at launch. Defendants also touted a readily available trading market for Grams, including one leveraging its hundreds of millions of Telegram Messenger users; sold Grams to purchasers at deeply discounted prices for its own projected secondary market price at launch; and promoted the future transferability of Grams into a liquid market.

- To be derived from the entrepreneurial or managerial efforts of others: The Offering Documents explained that “Telegram had a world-class team of 15 developers…experience[d] in building scalable projects for tens of millions.”

The Bottom Line: If it walks and talks like a security, it probably is a security

“We have repeatedly stated that issuers cannot avoid the federal securities laws just by labeling their product a cryptocurrency or a digital token,” Steven Peikin, Co-Director of the SEC’s Division of Enforcement.

If you are interested in this topic, please stay tuned for my upcoming podcast at the end of the week!