Search Posts

Recent Posts

- Do you meet the definition of an “Accredited Investor” under the new SEC Rules? December 8, 2020

- Do You Really Have Time To Read & Understand The Heroes Act? November 23, 2020

- Governor Newsom – Please Order all Court Buildings in the State of California Closed starting March 16 March 15, 2020

- Three Men Arrested in $722 Million Cryptocurrency Fraud Scheme Targeting “Dumb” Investors December 10, 2019

- Should Court Transcripts be Provided to Parties Free of Charge? December 3, 2019

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

PlexCoin ICO Scam Promised Astronomical Returns before the SEC shutdown

ICOs are on the rise and the SEC’s Cyber Unit is proactively fulfilling its promise to protect investors against cyber-related misconduct involving distributed ledger technology and ICOs. Earlier this month, the SEC filed fraud charges against Dominic Lacroix, age 35, Sabrina Paradis-Royer, age 26 (Lacroix’s business partner), and PlexCorps aka PlexCoin, an unincorporated entity (Lacroix’s company).

The SEC’s complaint, filed December 1, 2017, describes the following characteristics of the ICO scam:

- Unregistered and No Applicable Exemption: No registration statement was filed or in effect during its fraudulent offer and sale of securities and no exemption from registration applied.

- “Enormous” and “Real” Returns: Investors were promised returns of 1,354% in 29 days, possibly as high as 88,737% despite no reasonable basis to project these returns on investment.

- Openly Defiant: Lacroix and Paradis-Royer misappropriated funds and engaged in other deceptive acts despite having been enjoined by a Quebec tribunal from future violations of the Quebec Securities Act.

- Satisfies the Howey Test: Investors were promised returns based on the efforts of PlexCorps’ team, the distribution of profits from the PlexCorps enterprise, and the appreciation in value of the PlexCoin Tokens based on the efforts of PlexCorps’ “market maintenance” team.

- Undisclosed Executives: PlexCorps had to hide the identities of executives to avoid poaching by competitors and for privacy concerns. Lacroix’s identity was probably not disclosed because he was a known recidivist securities violator in Canada.

- Offering Proceeds used for Home Décor Projects: We all like HGTV but this is absurd. Proceeds were also used for undisclosed personal expenditures.

- Material Misstatements and Omissions: Material misstatements and omissions occur in various Internet postings, social media and the whitepaper.

- Movement of Money: Investor funds were channeled through various fiat currency accounts and cryptocurrency addresses on various blockchains.

- Just like Bitcoin: PlexCoin Tokens were likened to cryptocurrency like Bitcoin but they were securities within the meaning of the U.S. federal securities laws.

- Guaranteed Listing: The whitepaper promised investors that PlexCoin would be available for purchase and sale on “exchange platforms” such as Bittrex despite the fact that exchanges like Bittrex perform a level of review prior to listing.

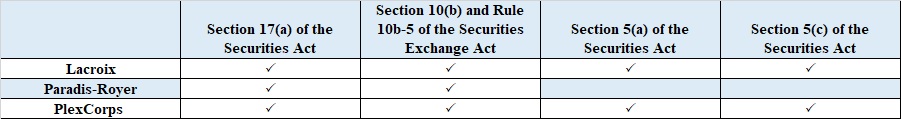

The SEC’s complaint is an emergency stop action to prevent Lacroix and Paradis-Royer from further misappropriating investor funds through their ICO scam that raised $15 million from thousands of investors worldwide. The following table summarizes the alleged U.S. federal securities laws violations:

Québec’s Autorité des Marchés Financiers (QAMF), the Canadian Securities Regulator, has announced that Lacroix will be going to jail for two months and will have to pay a $100,000 penalty. According to PlexCorps Facebook Page, PlexCorps intends to cooperate with the QAMF and the SEC until the end of the investigation.

[…] According to the U.S. Securities and Exchange Commission’s (“SEC”) complaint filed December 1, 2017, Dominic Lacroix, Lacroix’s business partner Sabrina Paradis-Royer, and Lacroix’s company PlexCorps aka PlexCoin, an unincorporated entity (collectively “Defendants”), fraudulently raised $15 million from thousands of investors worldwide. The fraud included failure to file a registration statement, promises of astronomical returns possibly as high as 88,737%, and material misstatements and omissions. You can read more about the PlexCoin ICO Scam in my previous blog. […]

This is my first time pay a quick visit at here and i am actually pleassant to read everthing at one place.

Hey very interesting blog!