Search Posts

Recent Posts

- Do you meet the definition of an “Accredited Investor” under the new SEC Rules? December 8, 2020

- Do You Really Have Time To Read & Understand The Heroes Act? November 23, 2020

- Governor Newsom – Please Order all Court Buildings in the State of California Closed starting March 16 March 15, 2020

- Three Men Arrested in $722 Million Cryptocurrency Fraud Scheme Targeting “Dumb” Investors December 10, 2019

- Should Court Transcripts be Provided to Parties Free of Charge? December 3, 2019

Categories

Subscribe!

Thanks for subscribing! Please check your email for further instructions.

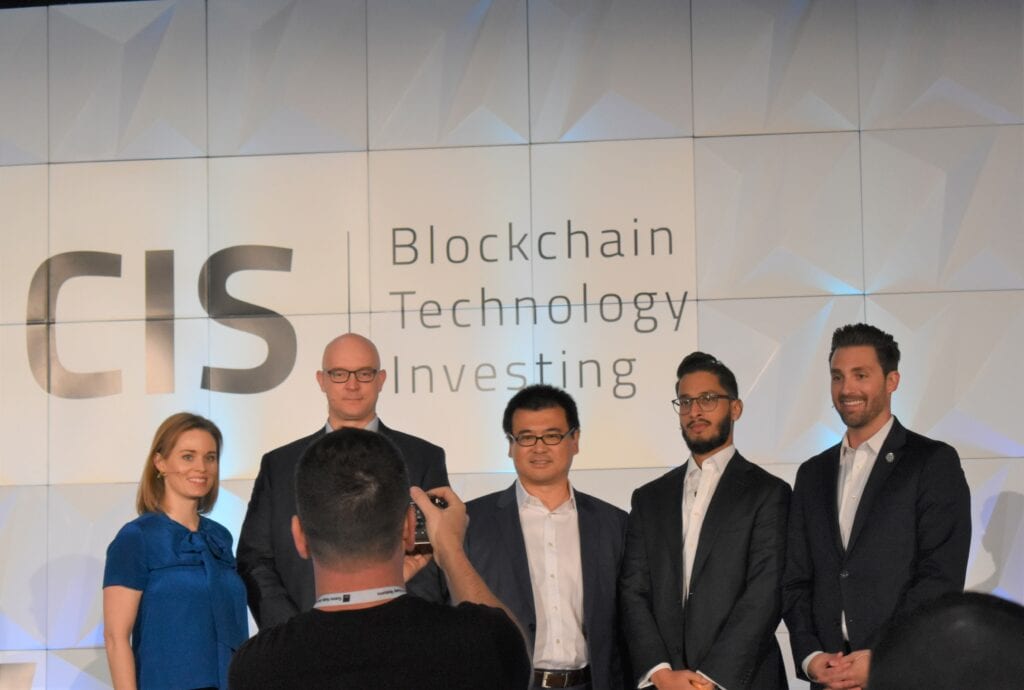

Crypto Invest Summit 2019 in Los Angeles: Summary and Pictures

Name of Event: Crypto Invest Summit (CIS) 2019

Date of Event: October 15-16, 2019

Location of Event: Los Angeles Convention Center

Number of Persons Attending: 200 (on October 16, 2019)

Gold Sponsors: etoro, Vertalo, Casperlabs, innovesta, Ownera, Totle

Summary

On October 16, 2019, I attended two panel discussions at CIS 2019 on a beautiful in Downtown LA. Compared to CIS 2018, there were far fewer attendees which may have been due to the current cryptocurrency bear market. Despite this, there were heavy hitters on the panels who shared valuable insight. The exhibitors did a great job of promoting their products or services and the Global Hackathon was a lot of fun.

Panel 1: Regulatory Headwinds in the U.S. with Perianne Boring, Brett McDowell, Phil Liu, Yusuf Hussain and Ian Calderon

Perianne Boring asked the panelists about topics like the SEC’s recently issued 112 page Order Disapproving a Proposed Rule Change related to NY’s Bitcoin ETF approval, the Virtual Commodity Association, the SEC Order for Block.one to pay a $24 million penalty for unregistered ICO and the recent Telegram ICO shutdown.

Brett McDowell discussed the importance of getting clarity at the federal level in the tech space and suggested the idea of adopting a regulatory sandbox because anyone who wants to enter the space has to spend exorbitant amounts of money. Brett believes that the creation of a non-exclusive safe harbor for the offer and sale of certain tokens, as described by U.S. Securities and Exchange Commissioner Hester Peirce, would make the U.S. a leading vision for the world for distributed ledger technology companies.

Phil Liu described the fact that a few people control a large percentage of Bitcoin so that any one of them can manipulate the prices. There are known issues with transparency in the space. It is time for the industry to organize an SRO in the cryptocurrency space to bridge the gap between the SEC and the CFTC.

Yusuf Hussain echoed Phil’s sentiment that there is path forward to responsibly becoming an SRO. Yusuf highlighted that regulation needs to be moving at the pace of innovation. Until then, it is imperative for companies in the space to engage with regulators early and often.

Ian Calderon described the government standpoint on how to foster innovation and creation while providing regulatory oversight. He described the lawmaker as the party that tells the cop what to enforce, not the cop. Mr. Calderon discussed his experience in a working group as one in which the people are not always in agreement with whether something is in fact a best recommendation.

Panel 2: The Role of Government in Regulating Cryptocurrencies with Adam Chapnick, Rob Nance, Grant Blaisdell and Justin Newton

Adam Chapnick introduced and moderated this “controversial panel on regulation” which was short but sweet. The bottom line: all panelists agreed that regulation is important.

Adam Chapnick introduced and moderated this “controversial panel on regulation” which was short but sweet. The bottom line: all panelists agreed that regulation is important.

Rob Nance stated that fair and transparent markets are necessary. He believes that most people don’t understand how Libra and its digital wallet, Colibra, work; he is right.

Justin Newton discussed how crypto is a tool and platform. He referred to the Financial Action Task Force as a body that sets standards and has identified issues with issues regarding Libra and Telegram, including terrorists and other bad actors that are financing operations with crypto.

Grant Blaisdell discussed the importance of regulation because of the rampant use of crypto for illicit activities. He also discussed the fact that while there is theft in the space, if funds are stolen and then liquidated on one of the largest exchanges of the world, it can be determined how much holdings have changed which can then make it traceable.

More Security Token Panels

Exhibitors

The Global Hackathon by Blockchain Beach

Several smart young people presented their ideas to solve important issues such as financial literacy. A 17 year old high school student who is CEO of his company presented an idea to increase collaboration among competitors instead of competing in a cutthroat way. Overall, it was a lot of fun.

If you have any questions or comments on any of the subjects mentioned above, please let me know or leave a comment below!